What payment plans can retailers offer to non-prime customers?

July 6, 2023

4 min read

Point-of-sale financing has become a popular way for people to pay for larger purchases. Nearly half of all U.S. consumers have financed a purchase in the last twelve months.

Retailers typically offer store credit cards and buy now, pay later options, but 47% of U.S. consumers don’t have high enough credit scores for them. 1And of those customers with lower or no credit, 3 out of 5 will not make the larger purchase if another financing option is not available to them2.

On top of that, 30% of banks tightened their credit standards in Q2-2023, making it even more difficult for consumers to finance a purchase.

Continue reading to learn about who non-prime customers are, and what payment plans you can offer them.

Who are non-prime consumers?

Non-prime consumers have credit scores under 660 or have no credit at all. They represent 47% of the U.S. adult population, according to CFPB data.

Non-prime customers are rebuilding or establishing credit.

Major life events can result in customers having to rebuild their credit, including:

Job loss or temporary unemployment

Student loans

Medical bills

Divorce, which can lead to debt and issues with joint accounts, such as overdue payments and high credit utilization

Did you know? 40% of people who went through a divorce reported that their credit score dropped by 50 points or more.

Consumers establishing a credit history include recent college graduates, new members of the workforce, and immigrants.

What payment plans can retailers offer to non-prime customers?

Since non-prime consumers typically face rejection when they apply for prime financing options, retailers need to provide them with other ways to pay over time.

There are (2) alternative, non-prime financing options, that retailers can offer to their non-prime customers:

Second-look financing

Lease-to-own financing

Second-look financing

Second-look financing is a type of installment loan for customers with near-prime credit.

These loans are typically offered to customers who don’t quite have the credit for a prime loan—thus the term “second-look”. They typically have higher interest rates compared to prime financing options, but cost less than a lease if it is paid off over the full term.

Overview:

Credit score needed: 600 - 659

Max term length: 36 months

Typical APR: 34.99%

Market size: 23 million U.S. consumers (9% of the U.S. adult population)

Retailers should consider offering second-look financing if they want to provide near-prime customers with the “next best” financing option, with compelling terms similar to what prime providers offer.

Lease-to-own financing

Leases are the entry point into point-of-sale financing for as many as 98 million consumers who have credit scores below 600 or no credit at all.

A lease is different than a loan:

Instead of loaning money to the customer, the financing provider buys the item from the retailer and leases it to the customer

The customer gets to use the item during the leasing period and assumes ownership after their last payment

Customers can end their lease by returning the item to the financing provider

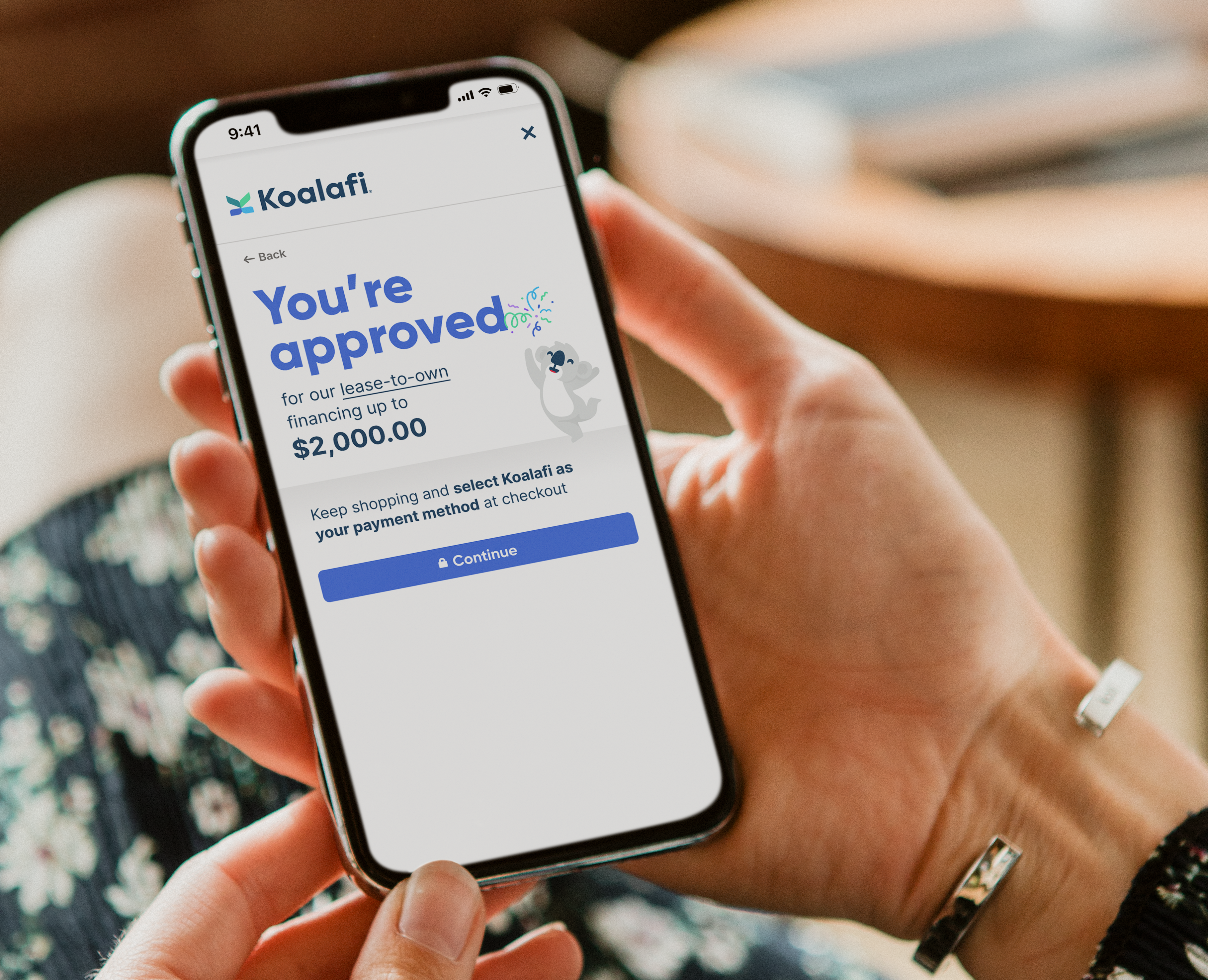

Customers can make fixed payment amounts over 12 or 24 months and have the flexibility of paying off their lease early to receive a discount on leasing costs. Koalafi customers who pay off their lease within 90-day early option period only pay the retail price plus any fees that apply to obtain ownership of the merchandise.

80% of Koalafi customers who pay off their lease do so before the full term, and 40% pay off their lease within 90 days.3

Lease-to-own financing has evolved over the last few years, particularly due to improved underwriting technology and a seismic shift to digital. This has led to a much simpler and more transparent application and payment process for customers.

According to ChargeAfter, retail adoption of lease-to-own financing is expected to increase 1.7x this year.

Overview:

Credit Score Needed: None

Max Term Length: 24 months

Max Financing Costs: 2.0x - 3.0x of retail price

Market Size: 98 million U.S. consumers (38% of the U.S. adult population)

Retailers should consider offering lease-to-own financing if they want to provide a payment option to a majority of non-prime consumers.

Koalafi specializes in lease-to-own financing — giving your customers a simple, transparent way to pay over time without traditional credit. See how Koalafi lease-to-own can help you grow your business.

1Consumer Credit Card Market Report, Bureau of Consumer Financing Protection, 2021

2Koalafi customer survey, Fall 2022

3Koalafi internal data, July 2023

Share

Other Articles

Customer Support

Mon-Fri 8:00am-9:00pm ET

Sat 8:00am-8:00pm ET

Business Support

Mon - Sat: 8:00am-10:00pm ET

Sun: 9:00am-9:00pm ET

365 days a year

Koalafi offers Lease-To-Own and Lending solutions. Loans issued by The Bank of Missouri, serviced by Koalafi