How the Wellsville Group is Overcoming Reduced Traffic by Leaning into Conversion

November 9, 2022

4 min read

Due to inflation and consumer concerns about the economy, reduced store traffic is a top challenge facing furniture, appliance, and mattress retailers in 2023.

How are leading retailers responding to capture demand and hit their targets?

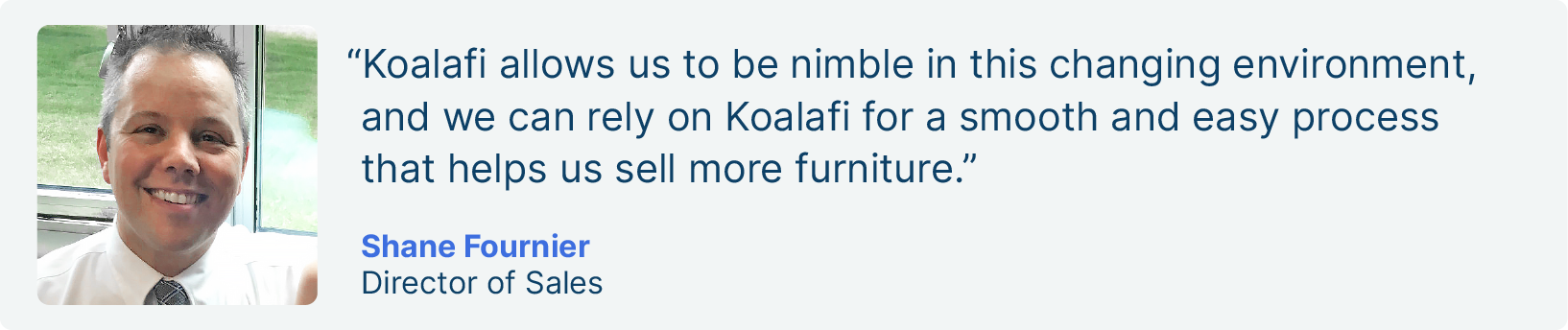

We spoke with Shane Fournier, the Director of Sales at the Wellsville Group, an Ashley licensee, about new tactics they’ve adopted to keep sales steady, despite a 20% drop in traffic. Fortunately, Shane’s story shows that retailers can successfully combat reduced demand with a willingness and ability to quickly adjust goals and try new things.

For the Wellsville Group, the key was to shift from a traffic to a conversion-mindset. Here’s what we learned about their approach.

About The Wellsville Group

The Wellsville Group dba Ashley, is a Furniture Today Top 100 furniture company headquartered in Weston Mills, NY, and employs more than 500 people. The Wellsville Group has offered Koalafi’s lease-to-own financing alongside their store card in 17 locations since 2019.

Responding to Challenging Market Conditions

With traffic dropping 20%, Fournier said their goal is to stay “flat,” which meant they had to go back to the drawing board for strategic plans. They shifted their focus to doubling down on increasing conversion and upselling customers in their existing stores.

However, the Wellsville Group hasn't lost sight of its longer-term expansion goals. They purchased a new building in New Philadelphia, OH which will open as an Ashley Store in 2023. They are also constructing a state-of-the-art distribution center in Aurora, OH.

Here are five of the methods that have been most effective for their business in this challenging economy.

1. Ensure Product Availability in Showrooms

Pandemic-induced delays, combined with the instant gratification “AmazonPrime” effect, mean that customers increasingly want to buy and take items home on the same day. When they can immediately enjoy their new purchase, they’re less likely to comparison-shop or change their mind.

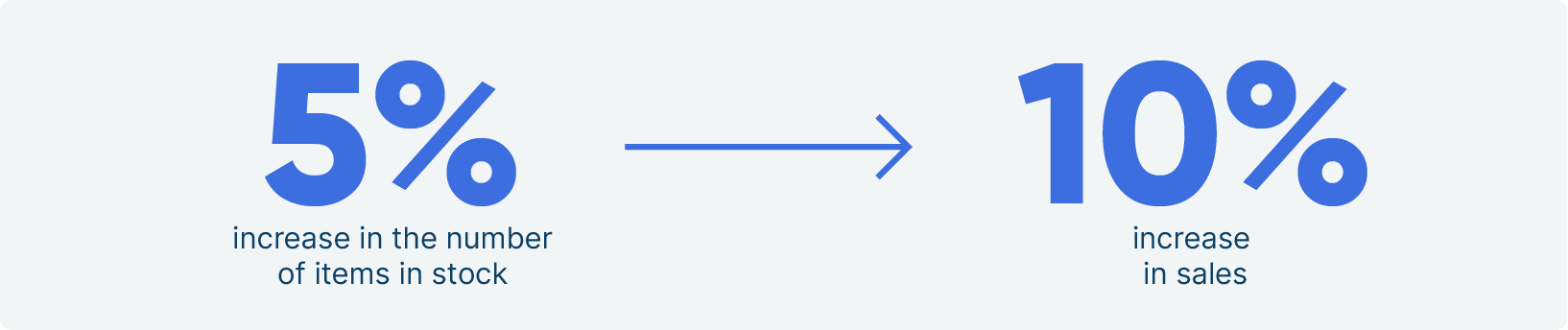

Taking this into account, the Wellsville Group increased the number of items in stock by just 5%. Almost immediately, they saw a 10% increase in sales.

2. Incentivize and Train Sales Associates

Retailers know how motivating competitions are for their sales associates. With that in mind, they repurposed their advertising dollars to offer more incentives to team members. Not only does this boost sales, but it also rewards the team and keeps them engaged and motivated.

The Wellsville Group has also doubled down on sales associate training. One of the focus areas is better incorporating financing into the sales motion to overcome price objections. One popular approach is to reframe prices into monthly payments with tactics such as “you can complete this living room for only $75 more per month.”

3. Host In-Store Events

While paid advertising has not been as effective, monthly in-store events have helped boost interest and get people into the store.

Some of these events are “warehouse sales,” which emphasize moving inventory. They also host events with creative themes. Charity events, such as pet adoption days or back-to-school drives, are also popular.

4. Personalize Selling

Shane’s team is increasing conversion with a more personalized approach to selling. The Wellsville Group found an opportunity to improve its technology with a Customer Relationship Management (CRM) system that captures and stores customer information.

With a CRM, they can see which products customers were interested in or previously bought and engage with that customer by phone, email, and direct mail. They can also identify the specific events and marketing campaigns that customers favorably responded to.

5. Focus on Financing

The Wellsville Group has also doubled down on promoting financing, including Koalafi’s lease-to-own plans, to its customers. This is a particularly powerful sales lever as customers’ budgets are tighter.

Shane recognized that promoting financing early and often can help close more deals, so he set new targets for the percentage of sales from financing to motivate the team.

With lease-to-own financing, they can offer compelling payment plans to approximately 47% of American consumers that are not eligible for prime financing, like store cards and buy now, pay later options.

The Wellsville Group relies on Koalafi as their only lease-to-own partner in 17 of their locations.

With Koalafi, customers can apply in as little as 60 seconds, making the financing process hassle-free for customers and sales associates.

On average, over 80% of Wellsville applicants are approved for a Koalafi plan, helping them close deals they would have likely lost otherwise.

Because of the value that Koalafi brings during this tough time, the team is increasingly promoting Koalafi to its customers. With this approach, the Wellsville Group’s total revenue generated through Koalafi increased by 60%.

Where is the industry headed?

Wellsville’s Fournier believes the industry is in for rougher times over the next 12 months. “With fewer people buying houses, there is less of a need for people to replace their furniture.” He believes the industry has not “bottomed out” yet, so he expects his stores to continue to find innovative ways to capture demand in the coming months.

Furniture companies must embrace new strategies to combat the decline in retail store sales. Retailers can take a page out of the Wellsville Group’s book with more attention on financing, ensuring popular items are in stock, offering sales incentives, and improving their customer data and technology.

All financing data in this article is based on The Wellsville Group's usage of Koalafi’s lease-to-own product.

Share

Other Articles

Customer Support

Mon-Fri 8:00am-9:00pm ET

Sat 8:00am-8:00pm ET

Business Support

Mon - Sat: 8:00am-10:00pm ET

Sun: 9:00am-9:00pm ET

365 days a year

Koalafi offers Lease-To-Own and Lending solutions. Loans issued by The Bank of Missouri, serviced by Koalafi