New HVAC Regulations in 2023: SEER Requirements, Tax Credits, and Expected Impact

October 17, 2022

7 min read

As of January 1st, 2023, the Department of Energy (DOE) is changing how manufacturers test heating, ventilation, and air conditioning (HVAC) systems for efficiency. The DOE’s new M1 testing procedures are strict and thorough, requiring a higher Seasonal Energy Efficiency Ratio (SEER2) to promote a more sustainable future.

But how does this impact HVAC contractors and their customers? Simply put, it means higher unit costs, which are then passed on to the customer. With higher prices, demand for consumer financing plans is likely to increase.

Although more energy-efficient units should lower users’ overall energy bills, the actual unit costs could be around 20% higher. Even though customers will see energy savings over time, they’ll still need to shoulder the initial expense. Let’s unpack the DOE’s new regulations and how HVAC contractors can leverage low-interest consumer financing options for their customers looking to upgrade.

New SEER2 Rating Requirements

An HVAC unit’s SEER2 represents the total heat removed from an air-conditioned space during the annual cooling season. The new M1 testing protocols will increase the systems' external static pressure (from 0.1 to 0.5 inches of water) to more accurately reflect field conditions after installation. Consumers and suppliers can expect new language denoting these M1 ratings.

Optimizing Energy Efficiency

The new SEER2 testing is meant to simulate external field conditions more accurately. As it stands, existing SEER testing doesn’t reflect some everyday factors, such as ductwork and static pressure. Ideally, by implementing the new M1 testing, we’ll better understand HVAC energy efficiency in the field

So what does that mean for HVAC manufacturers? New M1 testing will force manufacturers to redesign current system components. Even if they meet present SEER standards, all AC and heat pump systems must be adapted by January 1st, 2023, to be compliant. Furthermore, manufacturers have redesigned furnaces and air handlers to align with airflow setpoint changes.

Regulation Compliance Dates

As of January 1st, 2023, all regions will see a minimum increase of 1 SEER for AC units and heat pumps. This means the minimum efficiency needed to pass will increase by between 8% and 10%, depending on its British thermal units (BTU) capacity. Moreover, heat pumps will go through a nationwide efficiency increase to a minimum of 15 SEER.

The South and Southwest have a few more HVAC regulations to consider. AC units with less than 45,000 BTU will increase to 15 SEER. However, AC units with greater than (or equal to) 45,000 BTU will require a minimum of 14.5 SEER. All AC units in the northern US will need at least 14 SEER.

How Does This Impact Which Units Can Be Sold?

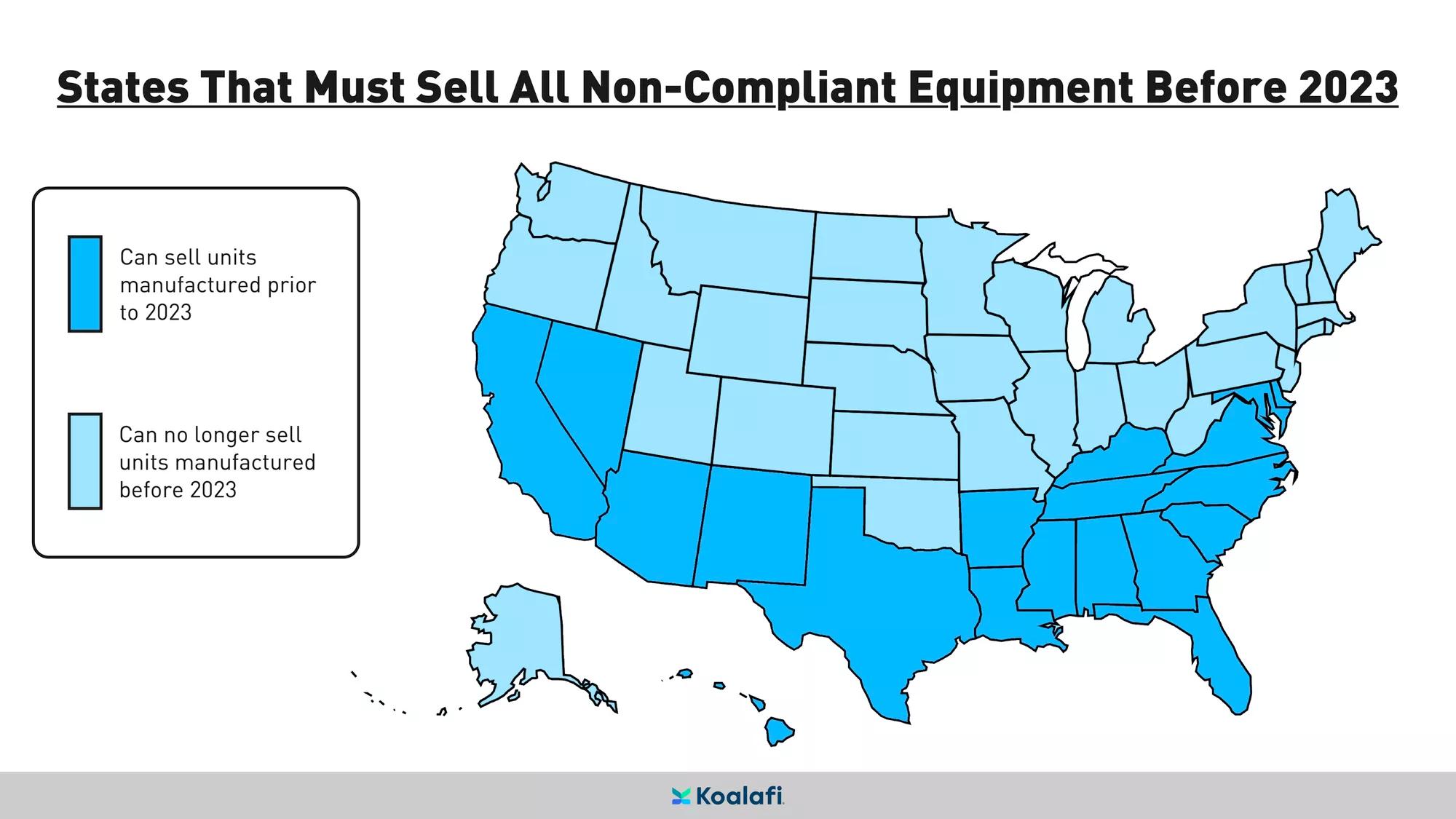

Compliance dates will differ depending on where you operate.

In the North, all non-compliant units made before 2023 can still be sold and installed.

Meanwhile, in the South, non-compliant equipment must be sold before 2023. This means that in the South, even if it was manufactured in 2022, it cannot be installed after January 1st, 2023. Contractors must sell non-compliant equipment before 2023.

What Does This Mean for Homeowners?

Industry insiders believe these changes will lead to equipment price increases of between 15% and 20%.

As an HVAC contractor, you need to make sure you help cushion the blow of the extra upfront costs for your customers. Thankfully, there are tax credits and financing that can help customers do just that.

Under the Inflation Reduction Act, customers can see up to $600 in tax credits for making energy-saving home improvements.

How do the tax credits work and how much money can they really save on qualified home improvements?

Tax Credits for Eco-Friendly Upgrades

Thanks to the Inflation Reduction Act, the current $600 tax credit replaced the old one (which expired in 2021).

The previous tax credit was worth 10% of the installation costs of energy-efficient solutions, such as insulation, windows, doors, roofing, and other eco-friendly conversions. However, the credit came with a lifetime limit of $500, not to mention several other thresholds for specific jobs.

Congress updated that old credit to make it more attractive for homeowners.

Beginning in 2023, the new Energy Efficient Home Improvement Credit will cover 30% of eligible home renovation costs made that same year.

The credit has expanded to cover expenses like energy-efficient HVAC systems (including pecific biomass stoves and boilers), home energy audits, and electric panels. However, roofing and air circulating fans no longer qualify.

In addition, the tax credit ceiling will increase from a $500 lifetime limit to a $1,200 annual limit. This allows your customers to spread out home improvement projects to leverage the $1,200 tax credit annually.

The credit increase also helps when moving homes and starting work on similar projects in the new home. However, there’s a $600 per-project limit, so homeowners need to budget accordingly.

Applying for the Tax Credit

Homeowners will need to file for these credits independently and won’t get the money until tax season. They’ll also need the manufacturer's Tax Certification Statement.

Thankfully, you can lighten the load by supplying these documents for your customers as an HVAC contractor. In the interim, however, buyers still need to cover the retail and installation costs of the equipment.

Offsetting HVAC Purchases With Tax Credits

So, how much will the tax credit offset the increased cost of home improvements under the new SEER regulations?

Let’s say your average AC unit ticket price is $7,000 today.

With the new regulations (assuming a 20% cost increase), that same unit will cost $8,400 in 2023.

Because this is a single project, your customers can only claim up to $600 in credit, leaving them on the hook for the extra $800. Furthermore, they’ll have to wait until spring to claim that tax rebate - meaning they'll still be on the hook for the whole $1,400 increase.

Financing Options for Upfront Expenses

Homeowners can turn to consumer financing to cover those steep upfront costs.

Companies like Koalafi help buyers purchase what they need with affordable, low-interest loans over as many as 120 months for customers with average to excellent credit and affordable lease-to-own plans for customers still building their credit.

How Financing Can Help Bridge the Gap

Financing providers like Koalafi may offer deferred interest loans allow customers to pay off their entire purchase before interest is due, making big-ticket products more accessible to a larger pool of buyers. Consumers may be eligible for up to $65,000 in loans, provided that the buyer has a good-to-excellent credit record.

On the other hand, buyers who are still building their credit may be better suited for a lease-to-own option. These plans can offer as much as $12,000 and are great for people looking to build their credit. But how do these two financing methods differ, and how do you know which is best for you as a buyer or business owner?

To Loan or to Lease?

With installment loans, the borrower receives an upfront lump sum (the principal) which they’ll repay in regular monthly installments. That principal goes directly to the retailer to cover the purchase cost, after which the item belongs to the buyer.

The buyer then makes fixed payments over several months (as low as 6 months, all the way up to 120 months, depending on the plan). The loan also comes with a finance charge (expressed as an APR) based on the principal added to the monthly payments.

The better the buyer’s credit record, the more likely they will be approved for one of these consumer financing plans.

As for lease-to-own, the financing company (in this case, Koalafi) purchases the item from the merchant and then leases the item to the buyer. The buyer still gets to use the item but doesn’t technically own it until they make their final payment. The buyer also agrees to a fixed-repayment amount instead of an APR, which will be paid over a period of 12–24 months.

With lease-to-own, the customer always knows how much they need to pay each month, giving them peace of mind. There are also options for the customer to pay the unit off early and save.

Lease-to-own is ideal for buyers looking to establish or boost their credit. Some buyers can still get approved even if they don’t have any credit—and since one in five Americans falls into this category, lease-to-own makes costly items more accessible.

Offering installment loans and lease-to-own alternatives will open your business to more potential customers. Many buyers walk away from a sale once they realize how much they’ll need to pay upfront.

Instead of losing a sale, companies like Koalafi make it easy for your sales reps to explain the buyer’s financing options and get them approved in seconds. Retailers get their money right away, and buyers go home with their new HVAC unit (or other big-ticket items).

Ready Your Financing Options with Koalafi

New SEER2 regulations for HVAC units may raise the overall cost to consumers by as much as 20%.

This increase will likely push those on the fence to delay their HVAC purchases because they can’t cover the upfront costs and may even price some buyers out of the market entirely. Retailers could lose out on valuable business opportunities without a means to help customers finance more costly items.

Buyers can look at other avenues for monetary relief, such as tax credits or consumer financing. Thankfully, they can leverage both of these possibilities when purchasing or upgrading their HVAC system.

Instead of coughing up the extra 20% today, they can make monthly, low-interest payments. Then, come tax season, they can expect their $600 credit (ranging up to $1,200 for multiple projects).

In the end, consumer financing is a win-win for buyers and retailers, especially given new DOE regulations and high-interest credit cards.

Share

Other Articles

Customer Support

Mon-Fri 8:00am-9:00pm ET

Sat 8:00am-8:00pm ET

Business Support

Mon - Sat: 8:00am-10:00pm ET

Sun: 9:00am-9:00pm ET

365 days a year

Koalafi offers Lease-To-Own and Lending solutions. Loans issued by The Bank of Missouri, serviced by Koalafi