How To Explain The Benefits Of Point-Of-Sale Financing To Your Customers

August 9, 2022

4 min read

Businesses of all sizes can promote consumer financing as a sales tool. However, not all shoppers understand the various ways financing can be a helpful tool for them. In addition to ensuring your website content, in store materials, and sales team can clearly explain how POS financing works, it’s also helpful to clearly communicate the benefits of financing to your customers.

Where do you start?

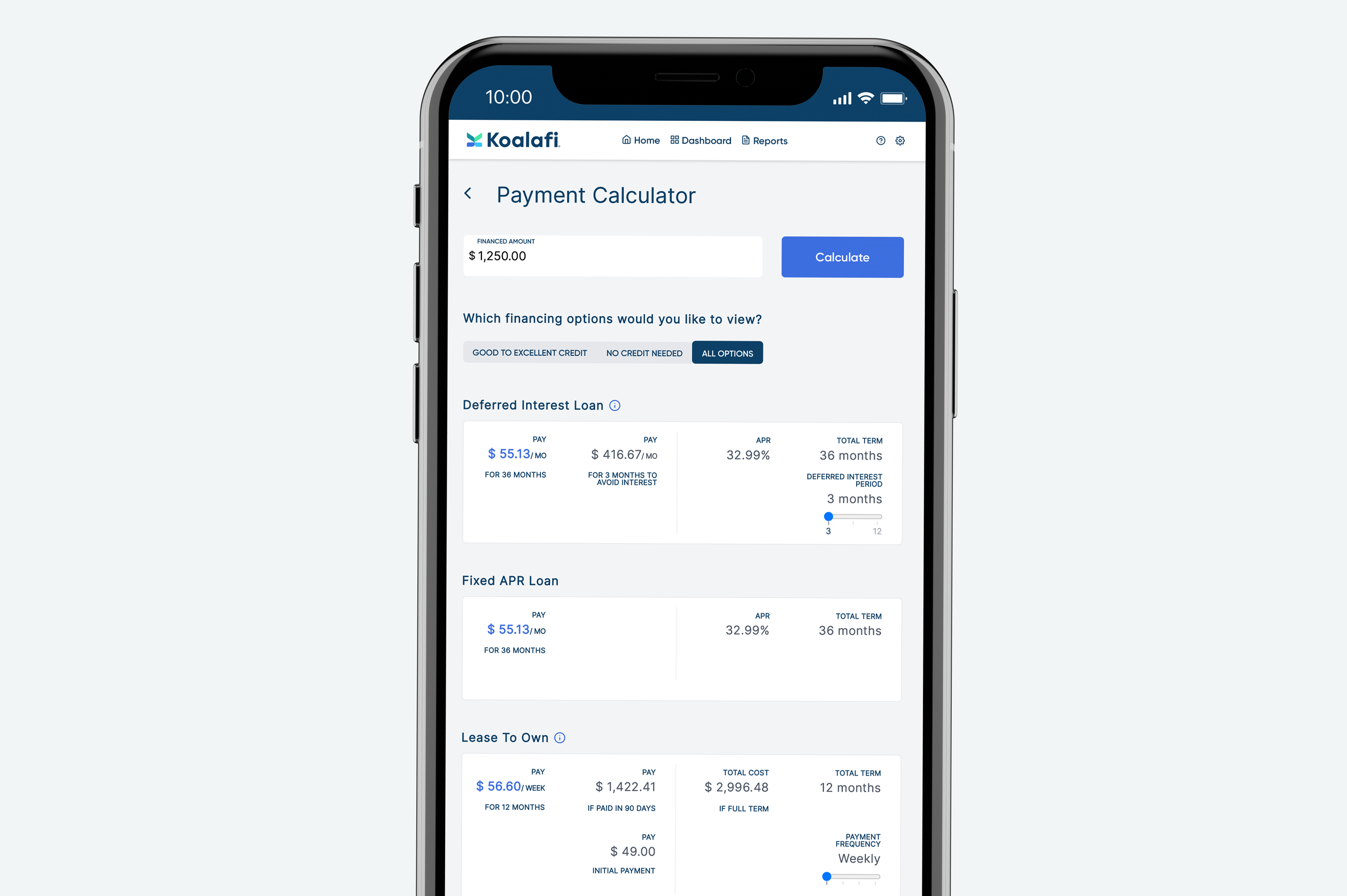

First, let them know there is a way for them to split bigger purchases into smaller payments, sometimes with fees or interest on top of the retail price. You should make it clear as to whether you are offering installment loans or leases and be knowledgeable about the differences, the payment plans, and the associated terms and costs. You should also ask your financing provider for training materials, or simple tools like payment calculators, that make it easy for your team to understand and explain the different options.

Once you have debriefed them on the basics of what financing is, explain the benefits. Financing options are budget-friendly, typically have a fixed interest rate or maximum leasing cost, and can even help shoppers build their credit scores.

Let’s take a deeper look at some of these consumer benefits.

Smaller payments are more manageable

Whether a customer is juggling multiple large expenses or a big life event has affected cash flow, your customers could have a long list of reasons why they might need more budget flexibility. Access to financing enables customers to get the things they need now while paying over time. Many retailers find that reframing big tickets into low monthly payments can open new purchase possibilities for their customers.

With financing, shoppers can split large purchases into smaller payments. While it doesn’t reduce the amount that the customer will pay overall (sometimes it’s higher), it does make budgeting and cash flow management easier. Consequently, this allows customers to afford new furniture, buy appliances, or maintain their homes without stressing their monthly budget.

Ask your financing company if they provide a payment calculator. This can be a great sales tool to show the customer examples of lower payments they can expect with financing to make this benefit of financing more tangible.

A fixed amount can give peace of mind

Installment loan financing often comes with fixed interest rates, meaning that the interest rate will not change over the term of the loan, regardless of factors like inflation. This is appealing to shoppers who are concerned about unpredictable interest rates often seen with credit cards or variable-rate loans.

If you offer lease-to-own financing, customers will always know the maximum amount of the lease upfront. This total lease cost (not including other fees like an initial payment) is often expressed as a multiple of the purchase price. For example, if a lease has a 1.5x multiple and an item costs $100, then the maximum amount a customer would have to pay over the duration of the lease is $150.

However, many financing companies offering leases give their customers the opportunity to purchase their item early, such as after 90 days, at the original retail price plus minimal fees.

Whether they have a fixed rate loan or a lease, customers will know the “worst case scenario," which can help them feel more confident in the decision to use financing.

It could help build their credit score

Credit cards are a common way consumers build credit. However, not everyone has a high enough credit score to qualify for a card in the first place. This presents a difficult catch-22 for many shoppers—you need a credit score to qualify for a card without exorbitant rates, but you need a card to build that score!

Financing, especially lease-to-own plans, are a great way for customers to establish or improve credit. If the financing provider regularly reports payment progress to a credit bureau, your customer will have an opportunity to increase their credit score. This means that over time they can qualify for more affordable plans and get approved for higher amounts.

To improve their credit score, customers will need to make their minimum payments on time. Fortunately, many financing companies accept “set it and forget it” automatic payments, making on-time payments effortless. Before signing the financing agreement, it is important that your customer closely reviews the payment schedule and fees so they can be confident they will be able to remain in good standing. Utilizing a payment calculator from your financing provider makes this evaluation very straightforward.

Leverage financing for your business

Financing, which Koalafi offers, has benefits beyond just cash flow management, and it’s important your customers have all the information to make the right decision for them. Financing can be a powerful tool for your business and your customers —but you must educate your customers about it first.

Share

Other Articles

Customer Support

Mon-Fri 8:00am-9:00pm ET

Sat 8:00am-8:00pm ET

Business Support

Mon - Sat: 8:00am-10:00pm ET

Sun: 9:00am-9:00pm ET

365 days a year

Koalafi offers Lease-To-Own and Lending solutions. Loans issued by The Bank of Missouri, serviced by Koalafi